School Teachers’ Review Body recommendations 2025/26

Pay award

The Secretary of State has accepted the independent School Teachers’ Review Body (STRB) recommendation of a 4% pay award to uplift the pay and allowances for teachers in England from 1 September 2025.

A process of statutory consultation has commenced with the following key dates:

-

statutory stakeholder consultation ended on 9 July;

-

estimates from the Department for Education (DfE) were that the final School Teachers’ Pay and Conditions of Service Document (STPCD) 2025/26 and the Statutory Instrument (SI) would be published on or about 18 July; and

-

the formal 21-day discussion period would then run until approximately 7 August.

Schools and employers will be able to consult on updating pay policies from 1 September for the first time in many years and teachers should receive the 4% uplift in their pay in September.

It is important to note that on 13 December 2024, both the DfE and HM Treasury included in their written evidence to the STRB that a pay award of 2.8% was sufficient and that it was to be funded only from existing school budgets and that no further funding would be made available by the government if the STRB recommended more than 2.8%.

NASUWT declared a dispute on 10 January 2025 with the Secretary of State for Education, Bridget Phillipson, on this issue. You can read the letter on the right/below.

There can be no doubt that we have shifted the government’s position on the matter of funding since December 2024.

Teaching and Learning Responsibility payments

In her Written Ministerial Statement to Parliament, the Secretary of State also accepted the STRB’s recommendation on Teaching and Learning Responsibility (TLR) payments for school teachers.

Up until 1 September 2025, the STPCD only allows for a part-time teacher to be paid the same proportion of any TLR1 or TLR2 payment they are in receipt of.

From 1 September 2025, and no later than 1 September 2026, TLR1 and TLR2 payments will be paid to teachers based on the proportion of responsibility they carry out, rather than their contracted hours.

For example, if a teacher undertakes the full role, they will receive full remuneration for this, but if they undertake only a portion of the role, they will receive remuneration in that proportion.

As all teachers have their pay reviewed annually, NASUWT expects any part-time teacher who is undertaking the full roles and responsibilities of a TLR1 or TLR2 will receive full payment of the TLR back dated to 1 September 2025.

Should an employer decline to do so, then members are advised to submit a pay appeal.

Support and advice can be sought from contact your Local Association Secretary.

Flexible working policy

The STPCD for 2025/26 ensures that all employees, including teachers, have the statutory right to make a request for flexible working from the first day of employment.

Schools are expected to have a clear flexible working policy in place, which responds to the needs of both staff and the employer and promotes a strategic approach to flexible working within the school.

Having a flexible working policy supports consistency and helps ensure schools are complying with their responsibilities under flexible working legislation.

Writing in the TES, Schools Standards Minister Catherine McKinnell said, “There is evidence that increasing flexible working opportunities can support teachers’ wellbeing and job satisfaction and boost recruitment and retention.”

Other public sector pay awards for 2025/26

-

school support staff and all other local government workers - 3.2%;

-

civil servants - 3.25%;

-

nurses, midwives, porters - 3.6%;

-

consultants, speciality doctors, specialists, GPs - 4%;

-

resident doctors (formerly known as junior doctors) - average 5.4% pay rise (includes a consolidated payment of £750);

-

fire service - 3.2%;

-

armed forces - 4.5% for most personnel;

-

senior officers - 3.75%.

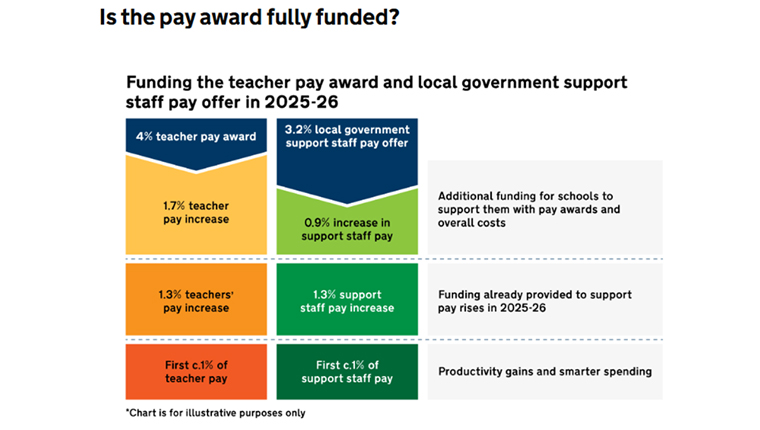

Funding the school staff pay award

There are three elements to how the government has identified funding for the school staff pay awards.

-

Additional funding of 1.7% for teachers’ pay awards and 0.9% for support staff will be delivered via a £615 million Schools Budget Support Grant (SBSG) for the financial year 2025/26, before being rolled into the National Funding Formula (NFF) for future years.

SBSG for the financial year 2025 to 2026

The £615 million funding provided by the SBSG is broken down as follows:

-

over £470 million for mainstream schools, in respect of their 5 to 16 provision;

-

over £10 million for Centrally Employed Services (CES) (within LAs);

-

£85 million for special and alternative provision schools, through the existing Core Schools Budget Grant (CSBG);

-

£30 million for schools with 16 to 19 provision through 16 to 19 funding allocations;

-

£15 million in respect of early years provision in schools.

How much of the £615 million SBSG will my school get?

The SBSG calculator will show the indicative allocations per school when the unique reference number (URN) is entered.

-

The Schools’ Costs Technical Note (SCTN) (pdf), produced annually by the DfE, was published on 31 March 2025. The SCTN aims to provide an understanding of the drivers of cost increases in mainstream schools in England at the national level based on the funding allocated. The analysis is split into two parts: the current financial year 2024/25 and a look ahead to 2025/26. The SCTN focuses on funding and costs of 5 to 16-year-old education, therefore excluding early years and post-16 provision from the analysis.

The SCTN has estimated that the average headroom, or unallocated funding from 2024/25, means that the average school is therefore deemed to have funding of 1.3% already provided to support pay rises in 2025/26.

Funding is allocated to schools via the NFF. This is a per-pupil amount. Therefore, schools which are not operating at or close to their published admission number (PAN) will be facing additional budgetary pressures.

-

Productivity gains and smarter spending (1% of the funding for the pay award).

To support schools, the government is providing a range of initiatives to help them cut the cost of things like energy and recruitment, as well as providing better banking solutions.

There are already examples of schools making savings and bringing costs down: the 400 schools that have participated in the Department’s new energy for schools offer will save 36% on average when compared to their previous contracts.

Ms Phillipson said, “We have driven efficiency through increasing digital capability both inside and outside of the DfE, reducing central headcount and removing duplication within programmes”.

We have also produced the 2025 report Where Has All the Money Gone? This report identifies further savings that the DfE can make and details the systematic misuse and abuse of public money and calls on the government to do more to curb such excesses and ensure that every pound of public money is spent efficiently on pupils.

If you have any examples of schools or academies misusing or abusing public money, then please email us, confidentially, with the details.

Teacher pay awards for the past five years

-

2024/25 - 5.5%;

-

2023/24 - 6.5% (7.1% for M1);

-

2022/23 - 5.0%;

-

2021/22 - 0.0%;

-

2020/21 - 2.75% (5.5% for M1).

NASUWT’s evidence to the STRB and the STRB’s 35th Report are available on the right/below.

Performance-related pay

Since September 2024, schools no longer have to have performance-related pay (PRP).

NASUWT has always said that this should be removed and it is our expectation that all schools should now have removed PRP as there has never been any evidence that it has raised standards.

Teacher pensions ‘innovations’

The STRB has expressed their concern over teacher pension ‘innovations’.

The STRB said it would be ‘concerned about innovation’ in teacher pensions being ‘used to reduce total remuneration’.

NASUWT endorses this view and expects all teachers to be automatically enrolled in the TPS.

The TPS is the default pension scheme of choice for teachers in that the government directly funds the employer contributions through HM Treasury, with the scheme being fully paid up (unfunded), and therefore constitutes an important part of the overall remuneration and reward package for teachers.

We continue to press the government to require all schools to remove PRP by no later than September 2026.

Anonymous feedback

If you require a response from us, please DO NOT use this form. Please use our Contact Us page instead.

In our continued efforts to improve the website, we evaluate all the feedback you leave here because your insight is invaluable to us, but all your comments are processed anonymously and we are unable to respond to them directly.