Supply teachers have a vital role in raising and maintaining high educational standards in schools. Campaigning to secure professional entitlements for supply teachers is a key priority of the NASUWT, together with securing decent pay and working conditions for all supply teachers.

The rise of umbrella companies across the recruitment agency landscape has meant that more supply teachers are being asked to sign contracts with them when they undertake work through an employment business (i.e. supply agency).

The NASUWT is concerned about the growth and prevalence of umbrella companies in education and the lack of transparency regarding how they operate and what they do.

The NASUWT is aware of the concerns raised by our supply teacher members about being required by employment businesses to join umbrella companies for payment of their salaries in order to ‘save tax’ on remuneration.

Normally, umbrella companies act as the legal employer for workers such as supply teachers, by providing them with an overarching employment contract whereby the umbrella company is treated as the employer for tax purposes.

The umbrella company sends a supply teacher on temporary assignments to the organisations where they are teaching, despite the fact that supply teachers still secure work through an employment business.

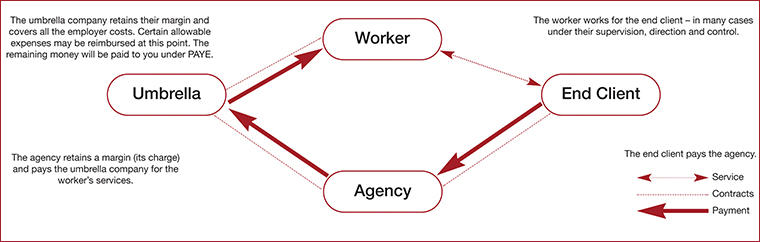

A typical umbrella arrangement involves four parties - the teacher, the school, the agency and the umbrella company. The teacher’s ‘employment’ contract is with the umbrella company, not the agency. Typically, the agency will agree an assignment and pay rate with a school and then look for a supply teacher to undertake the assignment.

A typical arrangement between these parties takes the following form:

-

the umbrella company will have a business-to-business contract with the employment agency;

-

the supply teacher will have a contract with the employment agency and umbrella company;

-

the client will complete a time sheet for the employment agency to confirm the hours/days that have been worked;

-

the supply teacher will supply the signed time sheet to the employment agency (and may be required to complete a similar time sheet for the umbrella company);

-

the umbrella company raises an invoice to the employment agency for the work undertaken by the supply teacher, plus any expenses agreed to be reimbursed;

-

the employment agency then pays the umbrella company;

-

the umbrella company processes the payment and any expenses and deducts the necessary tax and National Insurance (NI) contributions;

-

the umbrella company then makes a payment under the pay-as-you-earn (PAYE) system to the supply teacher; and

-

the supply teacher receives their money, less tax, NI contributions, the employment businesses commission fee and the umbrella services fee.

As employees of the umbrella company, supply teachers have the same rights as other employed persons. These include the right to be paid the minimum wage, the right to paid holiday, the right to be auto-enrolled into a pension (if you meet the earnings threshold) and the right to statutory benefits such as sick pay and maternity pay (provided that you meet the relevant criteria). You can find more information about employee rights on the Government’s web page Employment status.

Part of the reason that umbrella companies are used is that there is often a continuous payroll link from one assignment to the next, meaning it is less likely that a situation will arise where supply teachers pay ‘emergency tax’ when they begin a new assignment through a new agency.

In addition to this, umbrella companies are used because there is often beneficial tax treatment available in respect of travel, accommodation and subsistence expenses associated with supply work. However, the UK Government and Her Majesty’s Revenue and Customs (HMRC) have concerns that some umbrella companies are avoiding UK taxes and so there are question marks over the way they currently operate.

From a tax perspective, it may be possible to claim tax relief on travel, subsistence and temporary accommodation expenses in respect of providing your services. There have been wide-ranging concerns raised by HMRC and the Government over recent years as to the fairness of umbrella companies enabling their workers to claim expenses deductions that are not available to other workers.

In view of this, the NASUWT recommends exercising caution before entering into such a contract. This is because of the liability that supply teachers may personally face should the assumptions on which these companies operate be challenged and upheld.

In certain circumstances, HMRC could issue the teacher with a retrospective tax bill for any tax allowances they have claimed which are not allowable. The recourse against the umbrella company for their advice may be hard to enforce, particularly if they have protected themselves against this in the small print of the teacher’s contract by transferring the risk to the teacher.

The NASUWT has produced extensive advice and guidance for supply teachers on our Supply Teachers’ Tax page.

For any ‘overarching contract’ to be effective, there has to be ‘mutuality of obligation’ between the teacher and the umbrella company over the duration of your contract, meaning that the contract should state that the teacher will receive a minimum number of contracted hours and potentially, therefore, payment between assignments. Equally, the teacher should have a guaranteed minimum number of hours of work, which would provide an income safety net. However, the contract may prevent an individual from taking on work from other sources during this period, even if there are limited assignments.

For example, many contracts issued by umbrella companies guarantee at least 336 hours of paid work over the course of any 12-month period of employment.

Why do employment agencies favour the use of umbrella companies?

The main benefits of this arrangement sit with the employment agency, as they are able to avoid their obligations as the legal employer of a supply teacher (i.e. National Insurance Contributions (NICs) and payroll administrations costs).

How much will a supply teacher be paid if they work through an umbrella company?

Pay through an employment business

If paid directly by an employment business, then the rate offered (commonly known as the PAYE rate) is the amount, before tax and NIC, that should be received.

For example, if a supply teacher has a daily rate of £150 and works four days, they should be paid £600 as gross taxable pay. From this, there will be deductions for PAYE tax and employee NIC.

However, £600 is not the true cost to the employment business as they may have to pay costs like employers’ NIC, holiday pay, the apprenticeship levy and contributions into a workplace pension. As such, the cost to them may be more, but the daily rate received by the supply teacher remains the same.

Pay through an umbrella company

When an employment business uses an umbrella company, they should pass the umbrella company the full costs of the employment (e.g. £600 plus other costs) they have received from the school as the end-user client. This is commonly known as the limited company rate.

An employment business may explain to you that you will receive a daily rate of £150 if paid through the employment business, or £260 if paid through an umbrella company. The daily rate of £260 looks more attractive, but this is intended to cover the total costs of an assignment and is not the amount that a supply teacher would receive.

| Fee received by agency from school | This is paid to the umbrella company which makes the following deductions: | Supply teacher pay, including the following deductions: |

| Umbrella company margin | Employee NIC | |

| Employer pension | Employee pension | |

| Employer NIC | PAYE tax | |

| Apprenticeship levy (as appropriate) | Any other deductions (i.e. student loan) | |

| Holiday pay |

An illustrative example of a payslip is provided below:

| Pay advice | |||||

| Employee No 324567 |

Name Deborah Jones |

NI number NZ580873A |

Tax code 1250L [1] |

||

| Contractor statement | |||||

| Units/rate | Amount | Deductions | Amount | ||

| Agency receipts | 5 days @ £260 | £775.50 | Employer pension | £14.46 | |

| Employer NIC | £59.89 | ||||

| Holiday pay | £81.39 | ||||

| Apprenticeship levy | N/A | ||||

| Margin | £20 | ||||

| Employee payments | Units/rate | Amount | Deductions | ||

| Salary | 5 days @ £120 | £600 | Tax | £72 | |

| Employee NIC | £52.08 | ||||

| Workplace pension | £19.28 | ||||

| Total gross pay for tax: | £600 | Net pay: | £456.64 | ||

Supply teachers should, therefore, only enter into such an arrangement where the daily rate is sufficiently uplifted so that, once all lawful deductions have been made by the umbrella company, they are no worse off than if they had been paid the PAYE rate in the first place.

Reference to a ‘bonus’ and the National Minimum Wage on a payslip

The NASUWT is aware that some payslips processed through an umbrella company may make reference to pay at the National Minimum Wage (NMW) as well as a ‘bonus’. This can appear confusing, particularly when a supply teacher has agreed a daily pay rate.

Umbrella companies often structure payments in this way in order to limit their liability and protect them should the umbrella company not receive payment from the employment business for the work undertaken by the supply teacher.

In this scenario, the umbrella company would have to pay the supply teacher themselves. However, structuring a supply teacher’s pay in this way means the umbrella company is only liable to pay the NMW amount and not the bonus.

If you have been promised higher pay by your umbrella company

The NASUWT understands that some umbrella companies have been involved in promoting tax avoidance schemes which involve bending the rules of the tax system to pay less tax.

It is therefore imperative that you make yourself aware of how the umbrella company operates and watch out for a number of factors which could indicate that the umbrella company you are employed through is involved in tax avoidance. These include:

-

if you get a separate payment which you are told is not taxable, such as a loan;

-

if you get more money paid into your bank account than is shown on your payslip;

-

if you get a payment from someone other than your umbrella company, which has not been taxed; and

-

if you get asked to sign another agreement in addition to your employment contract.

Colleagues from HMRC are clear that if an umbrella company makes you an offer that sounds too good to be true, you should take time to consider it carefully and ask for full details.

You can find out more out more about tax avoidance schemes operated by non-compliant umbrella companies by visiting the HMRC's educational campaign page.

Holiday pay

If the contract provides for holiday pay to be deducted and paid at a later date, make sure the arrangements for payment are clear and fully explained so you receive your holiday pay entitlement when expected.

Furthermore, if you leave the employment of the umbrella company having taken fewer holidays than you are entitled to, you should be paid in lieu of any untaken holiday. Ask the umbrella company to confirm exactly how any outstanding holiday pay will be paid to you.

Some umbrella companies may include an amount for holiday pay on an ongoing basis. This is referred to as ‘rolled up’ holiday pay. The law states that this should be paid at the point when you take annual leave, but many agency workers prefer the ’rolled up’ system.

NASUWT members are therefore advised to ask for a copy of the proposed contract and read the details very carefully, including a detailed illustration of how you will be paid and all associated deductions that the umbrella company will make.

This should be compared to the pay which you would receive if paid directly by the employment business through PAYE.

Alternatively, you should request to be paid PAYE by the agency instead of through an umbrella company.

After signing a contract, check the payslips carefully to confirm that the correct deductions have been made. If anything on the payslip is unclear or causes concern, contact the umbrella company without delay. Alternatively, if the issue relates to tax liability, please contact HMRC direct.

Key Information Document

From 6 April 2020, employment agencies will be legally obliged to provide all agency workers, including supply teachers, with a ‘Key Information Document’.

The regulations will require employment agencies to provide information in one, succinct, written document (maximum two sides of A4 paper) that is easy to read.

This must be provided before an agency worker starts work.

Importantly, supply teachers who are employed by, supplied by or paid by umbrella companies will now know who their employer is, who will be responsible for paying them and the rate of pay they are likely to receive.

The recruitment agency has to state how much they pay the labour market intermediary and then how much the umbrella company will pay the supply teacher. They will also have to provide an explanation of these different pay rates.

Do supply teachers have to agree to work through an umbrella company?

NASUWT members do not have to work through an umbrella company as a condition of work, but, regrettably, it is not unlawful for an employment agency to only offer work to a supply teacher on this basis.

Supply teachers should request PAYE in the hope that an agency would rather agree to this than risk losing a supply teacher to another agency.

The NASUWT is aware that there are significant concerns about the use of umbrella companies. Supply teachers are getting less, schools are paying more, whilst agencies and umbrella companies are engaged in profiteering.

Disappointingly, where supply teachers prefer to have the option to be paid under PAYE, they have to accept having their pay processed through an umbrella company or face the choice of not being provided with any work. Some supply agencies exploit the precarious nature of supply teaching so that teachers feel they have no option but to sign up.

When teachers are engaged through an umbrella company, there is misinformation and a lack of transparency about their pay rates, specifically in comparison to the rate teachers believe was advertised or agreed with the employment agency.

If you have had experience, whether positive or negative, when using an umbrella company, tell us about it by emailing our supply line.

Further advice and guidance

For further advice and guidance, please contact the NASUWT. We can help with information and advice to support you throughout your time as a supply teacher.

Footnotes

[1] This is based on the standard tax code for 2019/20.