Tax guidance for supply teachers

Introduction

An introduction to UK income tax

Employment arrangements

PAYE and national insurance contributions

Tax reliefs and exemptions

The self-assessment regime for tax

Additional information and resources

Introduction

As a supply teacher, your employment arrangements can be more complex than those of permanent teachers. In turn, this can lead to increased complexity when it comes to dealing with UK Income Tax. In conjunction with tax advisers Crowe Clark Whitehill LLP, the NASUWT has put together this guidance to assist you.

Please note that aspects of this guidance, such as advice on self-employment and working through an agency/umbrella company, apply only to supply teachers working in England and Wales.

Helping you manage your tax affairs

The aim of the guidance is to give you a better understanding of the UK tax system as it applies to your situation to help you avoid potential pitfalls and manage your tax affairs more effectively.

Our objectives are to provide you with:

-

a concise overview of the UK tax rules that are relevant to supply teachers;

-

practical information that should be useful when it comes to managing your tax affairs; and

-

guidance on ‘non-standard’ employment arrangements (e.g. umbrella companies) and the potential implications for you.

This guidance will be of use to peripatetic teachers as well as supply teachers and is based on current legislation as at 6 April 2018. We aim to update the guidance as and when future legislative changes occur.

Please note that the guidance is provided for general information only.

What does the guidance cover?

The guidance deals with the practical implications of Pay As You Earn (PAYE) and National Insurance Contributions (NICs) for supply teachers, including the use of tax codes, allowable expenses and record keeping. As well as covering those teachers who have employment contracts with the organisations to which they are providing services, this document explains the position for teachers who work via local authorities and academy pools, employment agencies and umbrella companies. This guidance also explains the difference for tax purposes between being employed and being self-employed and the various reliefs that may be claimed as an employed or self-employed supply teacher.

Finally, we also provide guidance on the UK self-assessment system since, irrespective of the employment arrangements, supply teachers are often required to file UK income tax returns.

For further advice and guidance on your contract, please email the Member Support Advice Team.

It is important to note that the NASUWT is not able to offer members specific tax advice, so you should not rely exclusively on the guidance in this document to determine your income tax position. Members with a specific query about their own tax situation, or who are concerned about whether they are being taxed correctly, should contact Her Majesty’s Revenue and Customs (HMRC) or seek professional assistance.

An introduction to UK Income Tax

The UK tax system

UK Income Tax is calculated by reference to the 12 months which run from 6th April to the following 5th April. This is known as a tax year. It is often referred to by naming the two calendar years; for example, 2018/19 refers to the tax year ending 5th April 2019.

Your employer deducts tax from your wages before paying you the balance. Your employer is responsible for sending the tax on to HMRC. When you are paid, you should get a pay slip setting out your pay and tax.

At the end of the tax year, you should get a form P60 which sets out the total amounts paid to you and deducted from you for the previous tax year. There is a legal obligation on your employer to provide this by 31st May following the end of the tax year.

Assuming you are a UK resident for tax purposes, you can offset the UK Personal Allowance against your UK income. The PA for 2017/18 was £11,500 and for 2018/19 it was £11,850. [1] You are only entitled to one PA in any tax year, irrespective of the number of employments that you hold.

The last digit is then removed from the answer, leaving your tax code. For example, in 2018/19 a Personal Allowance of £11,850 with no adjustments would leave a code of 1185. The suffix L would then be added, indicating that the code could be automatically adjusted for Budget increases at the start of the next tax year. The suffix T would indicate a code that contains a number of adjustments and which should only be amended when notified by HMRC.

PAYE and NICs

If you are employed, it is likely that your income will be subject to PAYE and National Insurance Contributions (NICs) which are withheld via a payroll (see PAYE and national insurance contributions below). The responsibility for operating PAYE and NICs correctly normally rests with your employer. Your employer for PAYE purposes will depend on whether you are directly employed by an organisation, work via a local authority/academy pool, an employment agency or under an umbrella company (see Employment arrangements below).

PAYE is an estimate and is not necessarily the exact amount you are required to pay. The final amount may be more, or often less, than is taken into account during the year.

You should note that since 6th April 2013 employers have been obliged to report all payroll information, including details of joiners and leavers, online to HMRC in real time each time they run the payroll. This system is known as RTI (Real Time Information) and is intended to enable HMRC to respond rapidly to changes in an individual’s circumstances and to adjust tax codes more accurately.

Self-assessment

If you are self-employed for tax purposes (see Appendix II in the pdf on the right/below), then you will be required to report any income via a self-assessment tax return (see The self-assessment regime for tax below) and pay any tax due by the 31st January following the relevant tax year end. You may also be required to make payments on account towards your tax liability (see Appenidx II in the pdf on the right/below).

Even where you are employed and taxed under PAYE, you may still be required to complete a UK tax return where:

-

HMRC has sent you a return to complete or issued a formal notice requiring you to complete a return; and/or

-

you have untaxed income to report (e.g. bank interest, rental income or any income which has not been subject to PAYE in full).

Where you have not been sent a tax return to complete or do not have any untaxed income, you may still want to file a tax return where, for example, you have paid too much tax under PAYE during the tax year or possibly too little due to multiple employments.

Employment versus self-employment

Your tax status is important, especially where you are claiming to be self-employed, as this will determine whether or not you are subject to PAYE and what deductions and reliefs you may be able to claim. Whether you are employed or self-employed for tax purposes is not a matter of personal choice, but depends on the nature and terms of your engagement with the organisation you are working for.

HMRC looks very closely at cases where individuals are claiming to be self-employed and, in many cases, will seek to argue that individuals should in fact be treated as employees for tax purposes rather than as self-employed. Please see Appendix II in the pdf on the right/below for further details on determining your tax status.

Limited company

You may have decided to set up your own limited company to contract with schools directly. Please see Appendix III in the pdf on the right/below for further details.

Pension

Where individuals are in pension schemes, there are various tax implications. First, tax relief is available on pension contributions within the limits of the annual and lifetime allowance. If tax relief is not obtained directly, individuals may need to claim higher rate tax relief through their self-assessment return. Individuals also need to consider the effects of the annual allowance and lifetime allowance. See appendix V in the pdf on the right/below for further details.

Employment arrangements

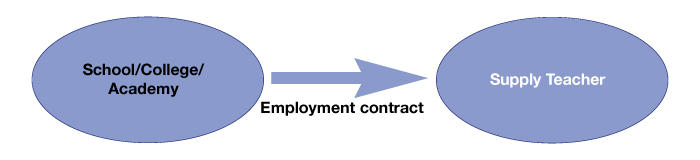

Direct contract (employer/employee relationship)

You may be working for just one establishment or for several. Either way, you should have a contract of employment with each organisation to whom you are contracted to work.

Overview

Pros and cons

This option is good if you have strong personal relationships with individual schools or colleges and can obtain regular assignments.

| Pros | Cons |

|---|---|

| Personal contracts | Time consuming to obtain work |

| Better daily/hourly rates | Limited HR support |

| No intermediary | Tax code implementation |

Tax implications

The tax implications of a direct employment contract with the organisation you are working for are normally straightforward as the organisation will be responsible for operating PAYE and NICs. However, the position may become more complex where you have several separate employments (see PAYE and national insurance contributions below).

-

On starting a new role, you will be required to present your most recent P45, if available, to your new employer (or each of your new employers where you have more than one). Please be aware that you can only present a P45 from your last employment to one new employer.

-

If you have no P45 when you start, your employer should ask you to complete a New Starter Form. This is the equivalent of the old form P46 which it has replaced since the introduction of RTI. This will inform HMRC whether:

-

this is your first job of the tax year;

-

you have worked before but this is now your only job; or

-

you have another job.

-

Where you have another job, the default position is that your Personal Allowance will be given to you in the tax code with your existing employer and you will be given tax code 0T (‘no allowances’) for the new assignment.

Consequently, if you obtain assignments from a number of different schools you may pay more tax under PAYE during the year than you should and you may have to wait until the end of the tax year before you can claim a refund. Equally, you could pay too little tax if under PAYE most of your income is taxed at 20%, whereas in aggregate some of your income should be taxed at 40% - the remaining tax will become due under the self-assessment system (see The self-assessment regime for tax below) in due course.

The only circumstances in which you will not be subject to PAYE and NICs by the organisation you are working for is where you are claiming to be self-employed. You should review Appendix II in the pdf on the right/below if this is the case. Normally, the employing organisation will need to be satisfied that you are genuinely self-employed before agreeing that PAYE and NICs are not required. If you are genuinely self-employed and the employing organisation agrees, you will need to settle your tax via self-assessment (see The self-assessment regime for tax below).

You may also work via your own Personal Service Company (PSC). [2] If so, you should be aware of the IR35 rules (see Appendix III in the pdf on the right/below) which may require you to operate PAYE and NICs on ‘deemed’ payments made from the school or academy to your PSC.

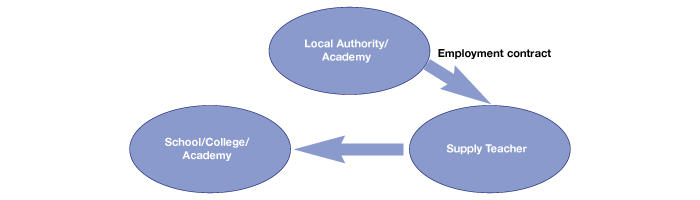

Local authority and academy supply pool

Where you provide your services via a local authority/academy supply pool, the local authority or academy will normally be your employer. The school, college or academy would normally seek staff from the pool but there would be no direct contractual arrangement between the local authority and the organisation for which you are providing services.

Overview

Pros and Cons

| Pros | Cons |

|---|---|

| Simple PAYE process (one pool) | Multiple income streams |

| Better economy of effort compared with direct liaison with each school | Potential tax overpayment to be recovered at year end |

| Pay based on experience and qualifications | Potential tax underpayment to be paid at year end |

| Access to Teachers’ Pension Scheme |

Tax implications

Where you are employed via a supply pool, the supply pool will be required to operate PAYE and NICs. PAYE should be simple if you obtain work from a single supply pool. However, if you use more than one supply pool, there could be a more complex taxation position for you to manage, with the tax code that gives you your personal allowances being assigned to your ‘main employer’ and the other pool(s) taxing you without allowances.

This may impact on your cash flow, with you paying more or less tax during the year than due and having to wait until after the year-end tax assessment is complete before you know what additional tax you have to pay or what tax refund might be payable to you. HMRC may adjust your subsequent tax code to compensate for any over or underpayment.

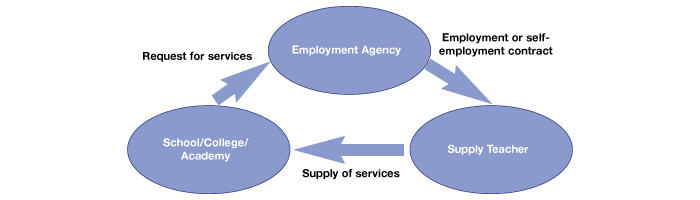

Employment agency

Overview

The vast majority of supply teachers obtain work by registering with one or more employment agencies. Many supply teachers choose to register with several agencies in order to gain access to a wider range of work assignments.

There are generally three parties involved in such arrangements:

-

the supply teacher;

-

the employment agency (that is, the organisation who identifies the needs of the school and organises the provision of the supply teacher); and

-

the client (that is, the person who requires the services – the school).

A typical arrangement between these parties takes the following form:

-

the supply teacher will have a contract with the employment agency;

-

the client will complete a time sheet for the employment agency to confirm the hours/days that have been worked;

-

the employment agency raises an invoice to the client for the work undertaken by the supply teacher plus any expenses agreed to be reimbursed;

-

the employment agency then processes the payment and any expenses and deducts the necessary tax and NI contributions.

Under these arrangements, the supply teacher must be working under an overarching employment contract. This means an employment contract between the employment agency and the supply teacher, which links a series of engagements into a single ongoing employment. In this case, the employment agency will be responsible for deducting PAYE and NICs from the supply teacher’s pay. In some cases, the teacher will not be an employee of the agency.

However, agencies may operate PAYE and NICs on the income that they pay to you on the basis of your contractual arrangements with them. Alternatively, if your agreement with them was to work on a self-employment basis, you will be responsible for your own tax and NICs. Accordingly, supply teachers will need to familiarise themselves with the particular arrangements they are employed under and ensure that PAYE and NICs are being operated correctly, especially where they are employed by an agency or umbrella company.

A number of changes arising from the Chancellor of the Exchequer’s 2014 Budget may mean that, where previously a supply teacher would have been treated as self-employed by an agency, the agency will in future be compelled to treat that same teacher as a PAYE employee (see PAYE and national insurance contributions below).

In some cases, the agency may employ the teacher directly with an overarching contract (see Umbrella companies below).

Pros and cons

| Pros | Cons |

|---|---|

| Economical way to find work | Multiple income streams |

| PAYE simple (if registered with one agency) | Complex income tax (if registered with multiple agencies) |

| No access to Teachers’ Pension Scheme | |

| Pay rates determined by individual agencies | |

| Lower daily/hourly rates |

Tax implications

Normally, where you are engaged via an agency, the agency will operate PAYE and NICs. However, in some cases, a teacher may be claiming to be self-employed - or the agency may insist that the teacher is self-employed - on the basis that the teacher is not required personally to provide services (i.e. the agency can potentially send a substitute in your place).

From 6th April 2014, agency workers formerly treated as self-employed may be subject to PAYE and Class 1 NICs where it can be shown that they work under the supervision, direction and control of the organisation at which they are teaching. If you are in this position, you should as soon as possible contact the agency concerned.

Ultimately, it will be the agency’s responsibility to operate PAYE and NICs on your income under the new rules, unless the agency is based outside the UK (in which case it will be the organisation where you are teaching that is responsible). However, teachers will no doubt want to know what financial impact this may have on them, as it may change the basis on which they are taxed (i.e. as an employee rather than self-employed) and may also affect the expenses they can claim.

Where you are currently being subject to PAYE and National Insurance by an agency, the PAYE taxation should be straightforward if you only use one agency and you should receive the correct cumulative treatment. However, being registered with several agencies may complicate the position, as you will usually have to nominate one as your ‘main employer’ for PAYE purposes. This agency will usually apply your main tax code, while secondary agencies will deduct tax using one of the two-digit tax codes explained below and in Appendix I in the pdf on the right/below.

A clear tax position will not be available until after the financial year end, when you will submit a tax return of your multiple income streams and any tax over (or under) payment will be assessed by HMRC. So, you may be paying more tax than is due over the year.

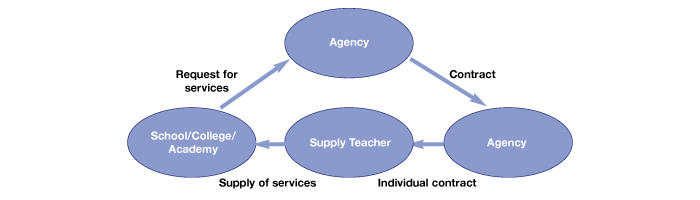

Umbrella companies

Overview

There has been a proliferation of umbrella companies over recent years. Normally, supply teachers will have an overarching employment contract with the umbrella company whereby the umbrella company is treated for tax purposes as the employer and, as such, the employer sends the teacher on temporary assignments to the organisations where they are teaching.

Part of the reason that umbrella companies are used is that there is often beneficial tax treatment available in respect of travel, accommodation and subsistence expenses associated with supply work. However, the UK Government and HMRC have concerns that some umbrella companies are avoiding UK taxes and so there are question marks over the way they currently operate.

A typical arrangement between these parties takes the following form:

-

the umbrella company will have a business-to-business contract with the employment agency;

-

the supply teacher will have a contract with the employment agency and umbrella company;

-

the client will complete a time sheet for the employment agency to confirm the hours/days that have been worked;

-

the supply teacher will supply the signed time sheet to the employment agency (and may be required to complete a similar time sheet for the umbrella company);

-

the umbrella company raises an invoice to the employment agency for the work undertaken by the supply teacher, plus any expenses agreed to be reimbursed;

-

the employment agency then pays the umbrella company;

-

the umbrella company processes the payment and any expenses and deducts the necessary tax and NI contributions;

-

the umbrella company then makes a payment through PAYE to the supply teacher;

-

the supply teacher receives their money, less tax, NI contributions and the umbrella services fee.

Pros and cons

| Pros | Cons |

|---|---|

| Economical way to find work | Pressure to claim expenses |

| Lower daily/hourly rates | |

| Potential HMRC liability on employee | |

| No access to Teachers’ Pension Scheme | |

| If the umbrella company is offshore - faceless/no direct contact if problems arise |

Tax implications

Where you are working for an umbrella company, it is the umbrella company’s responsibility to operate PAYE and NICs. This will normally simplify the process of deducting tax and tax codes, since you will only have one employer (i.e. the umbrella company).

From a tax perspective, it may be possible to claim tax relief on travel, subsistence and temporary accommodation expenses in respect of providing your services (see Tax reliefs and exemptions below). There have been wide-ranging concerns raised by HMRC and the Government over recent years as to the fairness of umbrella companies enabling their workers to claim expenses deductions that are not available to other workers. There have also been cases where erroneous claims for tax relief have been made, the most notable being Reed Employment plc v HMRC (2012).

In view of this, the NASUWT recommends exercising caution before entering into such a contract. This is because of the liability that supply teachers may personally face should the assumptions on which these companies operate be challenged and upheld. The NASUWT provides separate advice for supply teachers claiming travel and subsistence expenses.

If a teacher has relied on the ‘overarching contract’ to define their employment status, and claimed tax reliefs on this basis, they may have been working under a false assumption.

In certain circumstances, HMRC could issue the teacher with a retrospective tax bill for any tax allowances they have claimed which are not allowable. The recourse against the umbrella company for their advice may be hard to enforce, particularly if they have protected themselves against this in the small print of the teacher’s contract by transferring the risk to the teacher.

Further details on travel, subsistence and temporary accommodation expenses are included in Tax reliefs and exemptions below.

Additional considerations

For any ‘overarching contract’ to be effective, there has to be ‘mutuality of obligation’ between the teacher and the umbrella company over the duration of your contract, meaning that the contract should state that the teacher will receive a minimum number of contracted hours and potentially, therefore, payment between assignments. Equally, the teacher should have a guaranteed minimum number of hours of work, which would provide an income safety net. However, the contract may prevent an individual from taking on work from other sources during this period, even if there are limited assignments.

Further considerations are that the hourly or daily rate is likely to be relatively low, although the umbrella companies would claim that you are still better off through being able to claim tax relief for your travel expenses. You would be unable to benefit from the Teachers’ Pension Scheme.

Finally, remember that for tax reasons many of these companies are situated offshore and they may not be easy to get hold of should the need arise.

If you have been promised higher pay by your umbrella company

Some umbrella companies promote tax avoidance which involves bending the rules of the tax system to pay less tax.

Your umbrella company could be involving you in a tax avoidance scheme if you get:

-

if you get a separate payment which you are told is not taxable, such as a loan;

-

if you get more money paid into your bank account than is shown on your payslip;

-

if you get a payment from someone other than your umbrella company, which has not been taxed; and

-

if you get asked to sign another agreement in addition to your employment contract.

If the umbrella company makes you an offer that sounds too good to be true, take time to consider it and ask for full details.

Find out more about tax avoidance schemes operated by non-compliant umbrella companies by visiting the HMRC's educational campaign page.

PAYE and National Insurance Contributions

Pay As You Earn

Most people working in the UK are taxed through the Pay As You Earn (PAYE) system, operated by HMRC through employers, so that tax is deducted on account from monthly or weekly pay during the financial year (6th April to 5th April) rather than collected at year end.

Most employees are entitled to a certain amount of tax-free income each year (the Personal Allowance) and the PAYE system is designed to give employees the benefit of their tax-free allowance in ‘slices’ each pay day, so that at the end of the tax year the employee has paid approximately the right amount of tax for the year.

If the amount of tax shown on your payslip appears too high or too low, the fault may not lie with your employer. Under PAYE, your employer(s) is not permitted to use any tax code other than the most recent one they receive directly from HMRC. If your estimated income on the tax code notification from HMRC appears much too high, it may be worth contacting HMRC to give them a more accurate (and honest) estimate of the income you anticipate earning that year, which may improve your tax code. Alternatively, you can leave it to the PAYE system to refund the overpaid tax when you leave a job or at year end.

Tax code

Each employee is given a tax code for the financial year by HMRC. The tax code normally consists of a number followed by a letter.

To calculate your tax code, HMRC takes your Personal Allowance for the year, adds any additional amounts or positive adjustments that may be due to you, then subtracts any restrictions that may be due, for example, to account for tax on benefits or savings interest or to recover any underpaid tax from an earlier tax year.

The last digit is then removed from the answer, leaving your tax code. For example, in 2015/16 a Personal Allowance of £10,600 with no adjustments would leave a code of 1060. The suffix L would then be added, indicating that the code could be automatically adjusted for Budget increases at the start of the next tax year. The suffix T would indicate a code that contains a number of adjustments and which should only be amended when notified by HMRC.

When the adjustments to your Personal Allowances leave a negative amount, the last digit is removed and a prefix K is added. This is a negative tax code and means that, instead of deducting a tax-free element from your pay before calculating your tax, your employer has to add a notional amount. Other codes you may come across are:

-

BR - everything to be taxed at the Basic Rate of 20%;

-

0T - no adjustment for tax-free pay, everything taxable;

-

D0 - everything to be taxed at 40%;

-

D1 - everything to be taxed at 45%;

- NT - nothing to be taxed at source.

For individuals who are subject to the Scottish rate of income tax, tax codes will be preceded by ‘S’, e.g. S1185L.

The tax code system works best with employees who have a single source of employment income and work regularly for the same employer. It is likely to work less smoothly with supply teachers. This is because you may have a succession of separate employments, or hold more than one employment simultaneously, either with the same employer or with multiple employers.

If you have two (or more) jobs, it is likely that all of your second (and third, etc.) income will be taxed at the basic or higher rate of tax, depending on how much you earn. This is because all your allowances will usually have been used against the income from your main job. This could occur for supply teachers where you are registered with two or more agencies or with two or more different local authorities.

How to change a tax code

In some circumstances, a teacher may want to consider asking HMRC to split their tax code between two or more employers. This can be arranged by means of a phone call to the HMRC helpline for employees on 0300 200 3300. (You will need to have your National Insurance number and your employers’ PAYE references handy.)

A teacher may receive an incorrect tax code when they change a job. For supply teachers, this could be when they leave a school, an academy group, an agency or an umbrella company, to start with a different ‘employer’. The previous employer will provide you with a P45 tax form, usually at or shortly after the end of your contract, which you will pass on to your new employer. The P45 will contain the tax code they should use when they pay you. However, you may have given the P45 to another employer and this is your second job, in which case the second employer would have to use an ‘emergency tax code’ (see Appendix I in the pdf on the right/below).

In practice, it can be difficult for HMRC to ensure that:

-

you are not given the benefit of your personal allowances more than once; or

-

you are not given the benefit of the basic rate tax band more than once.

If either of these events occurs, you are likely to have underpaid your tax at the end of the tax year.

You can use a ‘payslip calculator’ from an internet search to estimate how much Income Tax and National Insurance you should be paying. Examples of these facilities are included in Additional information and resources below, although the NASUWT does not endorse any.

Further details available from the Government tax codes web page are included in Appendix 1 of the guidance, available to download on the right/below.

Examples are shown below of how much tax is payable using the 2018/19 basic Personal Threshold:

Supply Teacher Tax Examples (2018/19)

| Tax code | 1185L | 1185L | 1185L | 1185L | 1185L | 1185L | |

|---|---|---|---|---|---|---|---|

| A | Gross income | £14,000 | £18,000 | £21,000 | £31,000 | £41,000 | £51,000 |

| B | 'Tax free' | £11,850 | £11,850 | £11,850 | £11,850 | £11,850 | £11,850 |

| C=A-B | Taxable | £2,150 | £6,150 | £9,150 | £19,150 | £29,150 | £39,150 |

| Tax due | £430 | £1,230 | £1,830 | £3,830 | £5,830 | £8,760 | |

| Calculations | |||||||

| Taxable at 20% | £2,150 | £6,150 | £9,150 | £19,150 | £29,150 | £34,150 | |

| Taxable at 40% | £0 | £0 | £0 | £0 | £0 | £4,650 | |

| Total taxable | £2,150 | £6,150 | £9,150 | £19,150 | £29,150 | £39,150 | |

| Tax at 20% | £430 | £1,230 | £1,830 | £3,830 | £5,830 | £6,900 | |

| Tax at 40% | £0 | £0 | £0 | £0 | £0 | £1,860 | |

| Total tax | £430 | £1,200 | £1,830 | £3,830 | £5,830 | £8,760 | |

| Tax rate | From | To | |||||

| 20% | £0 | £34,500 | |||||

| 40% (Threshold for 40% tax £46,351) |

£34,501 | £150,000 | |||||

| 45% | £150,001 | ||||||

No tax is payable on the first £11,850 earned, so if annual income is £14,000, only £2,150 would be subject to tax at the basic 20% tax rate. Total tax due would be £430 (excluding National Insurance). If annual income is £18,000, £6,150 would be subject to tax at the basic 20% tax rate. Total tax due would be £1,230 (excluding National Insurance).

The higher 40% tax rate applies from the point annual income exceeds £46,350. This is the sum of the tax-free allowance of £11,850 plus the 20% tax rate band of £34,500. Above £46,350, income is subject to tax at the higher 40% tax rate, until income reaches £150,000.

However, above £100,000, the tax-free allowance is gradually withdrawn. For every £2 of income over £100,000, the tax-free allowance is reduced by £1. So, when annual income reaches £123,700, the allowance is forfeited completely. However, these adjustments do not occur automatically within the PAYE system and will normally take effect during the self-assessment process.

Income in excess of £150,000 is taxed at the additional rate of 45%.

National Insurance Contributions

NICs are another statutory element of taxation on your earned income. An employee’s NIC is payable on earnings where the individual is aged 16 or over and under State Pension Age.

Currently, the State Pension Age for men is 65. For women born before 6 April 1950, the State Pension Age is 60. The State Pension Age for women who were born on or after 6 April 1950 will gradually increase from 60 to 65 between 2010 and 2018. For more information, visit the Government check your state pension age web page.

The State Retirement Pension and a number of state benefits are dependent on the NICs that you have paid. It is important, therefore, that you pay the right type and right amount of NICs in your employments.

Employees and employers pay Class 1 NICs on their employment income. Contributions are banded according to your level of earnings in the earnings period (weekly, monthly, annual etc. as appropriate). Each pay period is considered in isolation.

Briefly, the bands work in this way:

-

Earnings up to the Lower Earnings Limit (LEL) are exempt and do not count towards any benefits.

-

Earnings between the LEL and the Primary Threshold (PT) (employees) or Secondary Threshold (ST) (employers) are zero-rated but do count towards benefits.

-

For employees, earnings between the PT and the Upper Earnings Limit (UEL) are liable to normal contributions, while earnings in excess of the UEL are liable at just 2%.

-

For employers, all earnings over the ST are liable to contributions.

Unlike tax, for NIC purposes earnings from different employments are not normally aggregated, though this may sometimes happen if you hold two or more employments with the same employer or with closely associated employers. As a result, supply teachers will benefit from the exempt and zero-rated bands at each employment and will often pay less NICs than they would otherwise have paid if all their income were from a single source.

The Government has indicated that it is concerned about agencies and umbrella companies that employ temporary workers, including supply teachers, who are located outside the UK and outside the EU, as they can avoid paying employer NICs. New anti-avoidance legislation effective from 6th April 2014 is intended to stop this happening (see Appendix III in the pdf on the right/below).

If an employment agency or umbrella company tries to make you liable for the employer’s NIC, you are strongly recommended to contact the NASUWT.

Tax reliefs and exemptions

Tax relief and exemptions for the employed teacher

Subscription to a professional body

All employed supply teachers can claim tax relief on a subscription to a professional body, which includes a designated proportion of the membership fee of a teachers’ union. In the case of the NASUWT, members are entitled to claim tax relief on two thirds of their annual Union subscription.

To obtain this tax relief, you will need to contact HMRC and inform them that you are claiming for a subscription to a professional body. You will need to advise HMRC that the NASUWT is included on what HMRC calls ‘List 3’. [3]

The benefit of this tax relief depends on your marginal tax rate. To a basic rate taxpayer, this is worth £22.32 (£167.40 x 2/3 x 20%); if you are a higher rate taxpayer, it is worth twice as much, i.e. £44.64 (£167.40 x 2/3 x 40%).

NASUWT members have reported that HMRC apportions the annual amount as it is payable from 1st January each year: it will put the first three months (January to March) in one tax year and the remaining nine months (April to December) in the following tax year. You will have to repeat this process each year but will end up with a full year’s tax relief.

Specialist tools or clothes

Specialist supply teachers may be entitled to claim for additional items regarded as necessary to undertake their duties. For example, a PE teacher may be able to claim tax relief for training shoes or tracksuits, if they can demonstrate that the items are used wholly and exclusively for work purposes.

Splitting tax codes

As stated earlier, you may find it beneficial to ask HMRC to split your tax code and allowances over more than one employer.

You may also be able to reclaim overpaid tax or reduce the monthly tax bill by explaining to HMRC that its whole-year income estimates are overstated.

Agencies, umbrella companies and travel expenses

Under normal tax rules, employees can only claim tax relief for the cost of travelling to and from a temporary workplace, subsistence incurred in connection with those journeys, and overnight accommodation at or near the temporary workplace if it is not practicable for the employee to return home.

A workplace is temporary if the employee is assigned to that location for a period not expected to exceed 24 months. The workplace may still be temporary if the assignment is for longer than 24 months, but the employee must spend less than 40% of their working time at that location and they must attend that location either:

-

‘for a temporary purpose’, e.g. to attend a meeting or to carry out some other self-contained task; or

-

‘for a task of limited duration’, e.g. a project with a foreseeable completion date.

Agency workers are generally regarded by HMRC as having a permanent workplace at the premises of the client they are assigned to. Despite the fact that they may well spend less than 24 months at the location, each assignment is generally regarded as a separate ‘employment’ and not as part of a single ongoing employment with the agency. As a result, no tax relief is available for the cost of the employee’s travel to and from the client’s premises or for any associated costs such as subsistence or overnight accommodation.

The exception to this is where the agency can demonstrate that the worker is engaged under a single overarching contract.

Many umbrella companies maintain that each worker is their own employee engaged under an overarching contract. They, therefore, consider that each assignment is to a temporary workplace, allowing expenses to be paid tax-free. Often the expenses are not paid on top of wages but instead of wages, under salary sacrifice arrangements. As the Reed Employment vs HMRC case showed, these schemes can fall foul of an HMRC challenge unless the worker has an ongoing relationship with the umbrella company between client assignments and continues to receive remuneration.

The NASUWT advises you to get independent tax advice before placing any reliance on claims to tax-free expenses in this situation.

Keeping records

If you claim for any expenses, make sure you keep a clear audit trail and records of all journeys and purchases, including retaining all receipts, to support your case. Retain all payslips and expense receipts indefinitely, as these are your responsibility, not your employer’s.

HMRC can go back four years or up to six years if they suspect a teacher has wrongly claimed tax reliefs and up to 20 years if it thinks the teacher has knowingly made false or fraudulent claims.

What will happen if I get it wrong?

The consequences of getting this wrong can be to receive a large retrospective tax bill from HMRC, for which it would demand immediate payment. For example, if a teacher has claimed for train tickets for their ordinary commuting journey at £500 a month, or £6,000 a year, and has claimed tax relief at 40% as a higher-rate taxpayer, they will have claimed £2,400 tax relief that they may have to later repay (or £1,200 as a basic rate taxpayer). They would also face demands for interest and quite possibly a penalty as well.

Therefore, it is important to take specific advice to ensure you fully understand your tax position and any potential liabilities.

Tax relief and exemptions for the self-employed teacher

As a self-employed supply teacher (see Appendix II on self-employment in the pdf on the right/below), you may incur certain expenses which are associated with the provision of your services such as travel expenses, stationery costs, learning aids and materials, accountancy and professional fees, and business banking charges. Allowable expenses may be deducted from your gross income when determining your taxable profit for the year.

The basis upon which expenses may be claimed is different for self-employed individuals to that of employed individuals. In essence, self-employed individuals can claim expenses which are ‘wholly and exclusively’ for the purposes of ‘the trade’ (i.e. for the provision of their services). Allowable expenses are those expenses which you need to pay out in the course of earning business profits, resulting from the provision of your services.

You are not allowed to claim non-business expenses or any expenses which have a private element (i.e. where part of the expense is for your private benefit rather than solely for the provision of your services) unless the private element is ‘incidental’. For example, a self-employed supply teacher may be required to travel to and stay in a hotel some distance away from their home in order to deliver a seminar at an off-site teaching course in the hotel. Whilst the hotel may involve some private benefit, the private benefit would be deemed to be ‘incidental’ since there is no private purpose, i.e. the teacher is only staying at the hotel to deliver the seminar.

Allowable expenses

These include the following:

-

accountancy fees;

-

subscriptions to professional bodies (e.g. your NASUWT subscriptions);

-

business banking charges and costs;

-

travel expenses (incurred in order that you can deliver your services);

-

motoring expenses. You can deduct a fixed rate for each mile travelled on business, using fixed mileage rates or the actual expenses, worked out using detailed records of business and private mileage, to apportion your recorded expenditure. Further information on the fixed rates you can claim are included on the Government simplified expenses if you're self-employed web page;

-

stationery, equipment and technical instruments;

-

books (provided that you can show they were purchased wholly and exclusively for the delivery of your services).

Further details on expenses for self-employed individuals can be found on the Governement expenses if you're self employed web page.

Self-employed individuals may also be able to claim capital allowances for capital items which are purchased for use in the business (e.g. business premises). Further details on capital allowances can be found on the Government capital allowances web page.

Keeping records

As with employment expenses, it is important that you keep a clear audit trail and records of all journeys and purchases, including retaining all receipts, to support your case.

HMRC can go back up to four years or six years if it suspects you have wrongly claimed tax reliefs and up to 20 years if it thinks you have knowingly made false or fraudulent claims.

The self-assessment regime for tax

Who needs to file a UK tax return?

You will need to file a UK tax return if:

-

you are self-employed;

-

you are a company director (including director of a PSC);

-

HMRC has sent you a formal notice requesting you to complete a return;

-

HMRC has sent you a return to complete;

-

you have income to report that has not already been subject to tax in full at source (e.g. via PAYE). For example, you may need to file a tax return where the level of tax withheld from you during the year has been insufficient. Although not required, you may also want to file a tax return where you believe that you are owed tax (e.g. because you have been subject to an over-deduction of PAYE).

More information on filing requirements can be found on the Government self-assessment tax returns web page.

Self-assessment tax forms can be downloaded from the Government self-assessment forms and helpsheets web page.

Registering for self-assessment

The first step for self-assessment is to register with HMRC by submitting a form ‘SA1’ to the Revenue. HMRC will subsequently set up a self-assessment record for you and issue you with a ten-digit Unique Taxpayer Reference (UTR) number. This UTR serves as a reference for your self-assessment account and is required to file your tax return online. HMRC can take a minimum of six weeks to process this form, set up an account and issue you with a UTR. Therefore, we would advise submitting this form as soon possible. The form can be found on the Government register for self-assessment web page.

If you wish to submit your return online, visit the Government self-assessment tax return web page.

UK tax year filing deadlines

The UK tax year runs from 6th April to 5th April the following calendar year. If you are submitting a paper tax return, the filing deadline is 31st October after the tax year in question. If you are submitting an online return, the deadline is 31st January after the tax year. So, for illustrative purposes, the 2018/19 tax year would run from 6th April 2018 to 5 April 2019, with a filing deadline of 31 January 2020.

Payment deadlines

If you owe any tax, this must be paid to HMRC by 31st January following the end of the tax year. For example, if you owe any tax for the 2018/19 year, this must be paid by 31st January 2020.

As well as paying any tax owed for the tax year that has just elapsed, you may also need to pay the first of two “payments on account”, which are part payments towards your next tax bill. These payments on account are not always applicable, and depend on the amount of tax due and type of income received.

Any further payments on account would need to be made by 31st July following the end of the tax year. For example, on 31st July 2019, you would make your second payment on account for the 2018/19 tax year.

You can find further information on deadlines and paying your tax here:

Deadlines: Self-assessment tax returns

Payment of tax due: Pay your self-assessment bill

Late payment penalties

HMRC also imposes penalties if any tax owed is not paid by the relevant deadlines. More information can be found here:

Estimate the penalty due: Estimate self-assessment penalties

Enforcement actions: If you dont pay your tax bill

Late filing penalties

HMRC imposes penalties if returns are not submitted by the relevant deadlines. Further details can be found on the Governemnt Self-assessment web page.

Note, too, that if you miss the 31st October deadline for filing a paper return, you can then only file an online return. If you attempt to file a paper return after that, you will be penalised and the return may be rejected.

Additional information and resources

Eligibility for benefits for supply teachers

Depending on the nature of the contract and the eligibility criteria laid out by the Department for Work and Pensions (DWP), there may be the possibility to claim for some government benefits (i.e. Jobseeker’s Allowance and/or Working Tax Credit/Universal Credit).

The NASUWT strongly recommends that members check against the eligibility criteria on the Government Benefits web page. Members should then contact someone at the DWP or the Citizens Advice Bureau to pursue this further as the NASUWT is not able to offer members specific benefits advice.

TaxAid

A good source of further information is the website of UK charity TaxAid. This charity is able to assist anyone on low income, which is defined as less than £20,000 a year.

Details of how it may be able to help you are given in Appendix IV in the pdf on the right/below.

Examples of payslip calculators:

| HMRC | PAYE Tax Calculator |

|---|---|

| Other | The Salary Calculator Take Home Tax Calculator |

Footnotes

[1] Note, however, that if your total income exceeds £100,000, your PA will be reduced by £1 for every £2 of excess. You will have no PA at all if your total income reaches £121,200 in 2015/16 or £122,000 in 2016/17.

[2] The House of Lords Select Committee on Personal Service Companies (2014) reported that: ‘The term “personal service company” is not defined in law. It is understood generally to mean a limited company, the sole or main shareholder of which is also its director, who, instead of working directly for clients, or taking up employment with other businesses, operates through his company. The company contracts with clients, either directly or through an agency, to supply the services of its director.’

[3] The NASUWT is listed in HMRC Approved professional organisations and learned societies under N for National on List 3.