The NASUWT has campaigned, organised and taken industrial action against the pensions inequality which women suffer. Attacking women’s pension entitlements has been at the heart of Government policy since 2010 and the NASUWT has been taking continuous industrial action against Government pensions policy since 2011.

The NASUWT has made several substantial donations to Women Against State Pension Inequality (WASPI) and the NASUWT National Officers have also resolved to keep under review the need for further donations to WASPI.

The key issue for WASPI is the impact of the increase in the state pension age for women born in the 1950s. The NASUWT made it very clear to Government that the decision taken in 2011 to accelerate the increase in the state pension age would lead to additional hardship for women born in the 1950s.

Whilst opposing the Government’s detrimental changes to teachers’ pensions, the NASUWT ensured through its industrial action and negotiations with the Government that teachers born in the 1950s received full protection against the increase in the teachers’ pension age and the ending of the final salary Teachers’ Pension Scheme on 1 April 2015.

The NASUWT believes that there is a widening gender pensions gap in the UK and that this is unacceptable. In addition to opposing the increase in the state pension age, the NASUWT has also made clear to the Government the potentially discriminatory impact of these policies and employment practices:

-

the treatment of ‘contracted-out’ public service pension schemes from April 6 2016 onwards which impacts on state pension entitlements (which are themselves exacerbated by state and public service pension reforms);

-

the vulnerability of much of women’s employment, not least to Government attacks through ideologically motivated cuts to those public services with a large female workforce;

-

detrimental reforms to public service pensions, which are concentrated in particular in the non-uniformed public services of health, education, the civil service and local government, in which women predominate;

-

discriminatory working practices (and, in particular, a toxic mix of age and sex discrimination from which older women suffer), which result in a high dropout rate of women workers before their normal occupational pension age and mean that women workers either do not build up a high level of occupational pension provision or are forced to take their pensions early, with reductions, as their only source of income. This problem is exacerbated as the pension age increases under the Conservative Government;

-

cuts in social care provision, which lead to women having to give up work because of carer responsibilities (for example, for dependent parents) and prevent them from building up adequate levels of state and occupational pension provision.

The NASUWT has made clear to the Government that the following Government policies have a particularly detrimental impact on women:

The Single-tier State Pension

This has been presented by the Government as a ‘levelling-up’ of pension provision. It is nothing of the kind. Many women workers (including teachers) with breaks in employment because of motherhood and family responsibilities will not receive the full pension because the qualifying hurdle for the pension has been raised. In effect, it is a misnomer to describe the pension as ‘single-tier.’ The NASUWT has made it clear to the Government that:

-

millions of workers will miss out on the full pension because they were in contracted-out schemes such as the Teachers’ Pension Scheme (which has been contracted out since 1978);

-

the single-tier state pension is £155 per week but only 45% of all working people are likely to receive this;

-

most teachers may not reach the ‘foundation level’ to receive the full pension because they paid lower national insurance contributions when the Teachers’ Pension Scheme became ‘contracted-out’. Many women teachers, who have a low teachers’ pension, are relying on their state pension to avoid poverty in retirement;

-

the pension can be topped up to the ‘single-tier’ level, but teachers with intermittent employment or who are vulnerable or suffer hardship in other ways, are unlikely to be able to afford to do this.

Employment agency teachers

Vulnerable and low-paid teachers are likely to suffer from the introduction of the single-tier state pension. Many employment agency teachers fall into this category. Employment agency teachers suffer from intermittent and low-paid employment and many agency teachers do not have access to their own occupational pension scheme, the Teachers’ Pension Scheme, because of the weakness of the Agency Workers Regulations in this area.

NASUWT research indicates that women teachers may be disproportionately present In the agency teacher workforce. It is a high-level priority for the NASUWT to achieve full equality of terms and conditions for agency workers, including pension provision, and for this to be entered into primary legislation where necessary. Otherwise, the national scandal of the two-tier workforce will extend to poverty pensions for an increasing number of women workers.

The NASUWT has raised its concerns about the treatment of agency workers with the Secretary of State for Education and with officials in the Department for Education (DfE) and the Department for Business, Innovation and Skills (BIS). These discussions with Ministers have arisen because of the NASUWT national trade dispute with the Secretary of State for Education and NASUWT members’ continuous national industrial action.

Auto-enrolment

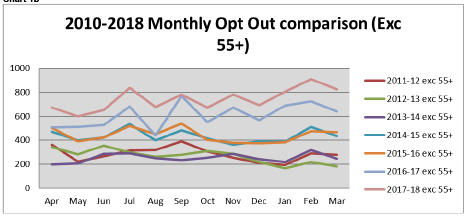

Data obtained by the DfE about optouts from the Teachers’ Pension Scheme indicate that a significant proportion of teachers opting out (up to 30% of teachers in any month) are teachers who opt out after being auto-enrolled, most of whom are women. The most common reason for opting out of the Teachers’ Pension Scheme is financial, including the unaffordability of pension contributions (which increased by an average of 50% under the Coalition Government).

One of the most significant problems though is that, for many agency teachers, the only pension they are offered is an auto-enrolled pension. Under the auto-enrolment regulations, this would eventually have a minimum employer contribution of three per cent. The employer contributions to Teachers’ Pension Schemes across the UK are far higher than this and, together with higher employee contributions, result in far better pension provision. The minimum standards in the auto-enrolment regulations need to be raised considerably to avoid poverty in retirement for many women workers.

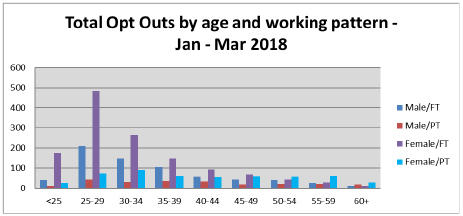

Opting out of the Teachers’ Pension Scheme

The DfE charts below demonstrate that optouts from the Teachers’ Pension Scheme continue to increase and that there is a particular focus on younger teachers opting out. They further demonstrate the focus on younger women teachers opting out, particularly in the 25-29 age group. The NASUWT is highly concerned about this trend, which will exacerbate the current gender pensions gap in the teaching profession. The NASUWT continues to argue that teachers who earn the least should pay the lowest pension contributions and that this policy benefits women teachers, who tend to be lower paid than men.

Freedom and choice pension reforms

The Government’s ‘freedom and choice’ pension reforms came into force on 6 April 2015. The NASUWT argued against the reforms, believing that they were both an electoral giveaway and also that they posed a high level of social risk, which the Government intends to manage (in part) by increasing the minimum pension age, which the Union opposes.

One of the most reckless of the reforms was the removal of the requirement, which had been in legislation since the 1920s, that a pension pot must be used to purchase an annuity which gives an income for the rest of the pensioner’s life. Pensions savings can be taken all at once, leaving pensions savers in poverty once their pensions pot has been spent.

Taking pension benefits all at once would lead to taxation of 75% of the pension pot, which has not been publicised by the Government. Research indicates that women tend to be more likely to use money they acquire to hold their families together than men and the combination of this and the impact of the Government’s austerity policies on women’s employment and social care means that, for many women, cashing in their pensions may seem to be their least worst alternative.

Equalisation of adult surviving partner benefits

The NASUWT believes that it is a scandal that discrimination against women’s partners continues as a feature of women’s public sector pensions provision in the UK under the current Government. See the NASUWT’s campaign for equal pensions.

NASUWT campaigning has led to a significant victory for women and their same sex spouses or civil partners. Following years of injustice, the Teachers’ Pension Scheme announced in April 2018 that adult survivor pensions for all same-sex spouses and civil partners would be based on the same accrued pension as adult survivor pensions for widows of opposite-sex marriages.

The NASUWT has led all other unions on this issue and has played a crucial part in TUC policy.

NASUWT successes

Against this background, the NASUWT has achieved some considerable successes in addition to the protections against detrimental changes to the Teachers’ Pension Scheme achieved for teachers born before 1 April 1962. These include:

- employee pension contributions paid on the basis of actual salaries rather than the full-time equivalent salary, which benefits women teachers because part-time teachers tend to be women;

- the preservation of beneficial conditions of service achieved under Social Partnership, such as guaranteed planning, preparation and assessment (PPA) time and a maximum classroom teachers’ working year, which have been under threat repeatedly since 2010. This acts to retain women teachers in the profession, who would otherwise be forced out;

- the full indexation of the Guaranteed Minimum Pension (GMP) element of the teachers’ pension from April 2016 onwards;

- detailed ongoing discussions on equality for women teachers with the Secretary of State for Education, other Ministers and DfE officials.

The NASUWT national trade dispute over pensions and the Union’s actions to defend women’s pensions will continue.

Anonymous feedback

If you require a response from us, please DO NOT use this form. Please use our Contact Us page instead.

In our continued efforts to improve the website, we evaluate all the feedback you leave here because your insight is invaluable to us, but all your comments are processed anonymously and we are unable to respond to them directly.